Navigating Private Investments in Data Centers

- Ingenie

- Jul 18, 2025

- 3 min read

Updated: Sep 15, 2025

2025 Data Center Outlook

Investments in data centres have emerged as a lucrative opportunity for private investors, as a diversification strategy from a traditionally favoured private real estate asset class. This has been driven by the exponential growth in data consumption and the growing penetration of artificial intelligence, with its reliance on cloud computing. Data centres provide critical infrastructure in the digital economy. However, while the potential for investment returns is attractive, traditional portfolio risk management and governance frameworks do not apply to this asset class.

This article explores the key risks and considerations associated with investing in data centres, including technological advancements, resource requirements and operational complexities. By understanding these factors, private equity investors can make informed decisions and strategically position their portfolios to capitalise on emerging opportunities.

Moody's Ratings data center outlook (2025) highlights several key trends:

Plans for massive AI data centre campuses to create long-term capacity demands of 1-5 GW of power requirements.

Capital Expenditure projections vary between $500 billion and $1 trillion globally by 2030.

Hyper-scalers are continuously adjusting their capacity plans to match uncertain future computing needs.

Innovation in computing and workload management is likely to come from China and Asia.

These trends present both challenges and opportunities for investment managers looking to allocate capital in their portfolios.

Investment Logic

In 2024, global asset managers Blackrock, KKR and MGX formed a $100 billion Global AI Infrastructure Investment Partnership with Microsoft. In Asia, technology firms such as NVIDIA, Microsoft, AWS, Google and ByteDance have committed $31.5 billion in regional digital infrastructure investments in Malaysia, according to the Data Centres Emerging Markets report (Q3 2024) by Knight Frank.

Significant capital flows into greenfield and brownfield projects highlight the need to regenerate critical physical infrastructure for power, cooling and water systems management. This makes them an attractive asset for private wealth and institutional investors looking to capitalise on technological advancements.

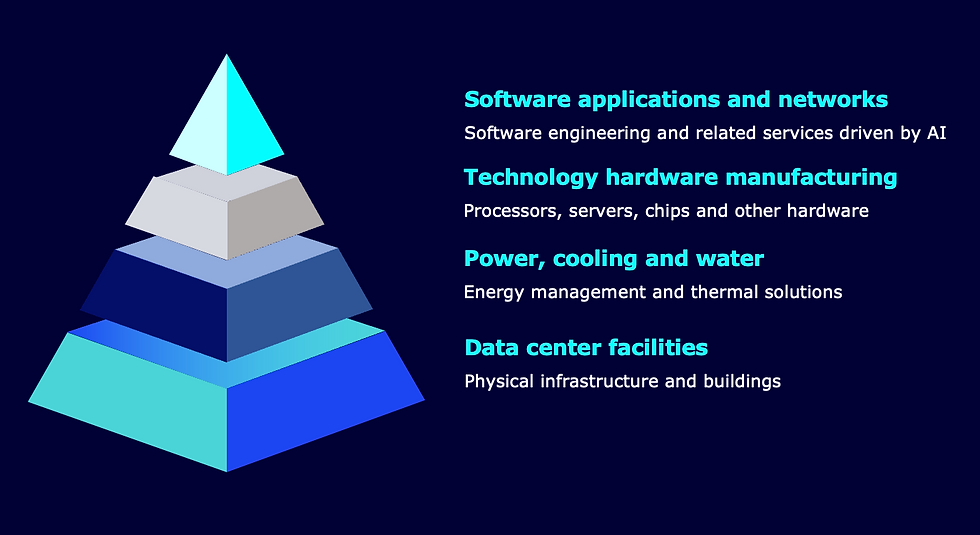

Industry verticals benefitting from the investment boom:

Financial Risks

Capital investments required for AI computing and the supporting digital infrastructure represent significantly higher financial risks than in previous technology cycles. The inter-connectedness of multiple industry verticals make data centres a complex, poorly understood and high risk asset class, requiring multi-layered due diligence covering financial, technological and environmental lens.

Ingenie considers all aspects of investment risks within our Strategic Risks framework:

Infrastructure & AI Efficiency

The assumptions for capacity and energy demands are based on current inefficiencies of AI models. Data centers are not able to address the efficiencies at the source, i.e., how software models and algorithms are designed and architected. Ingenie’s work resulted in proven reductions in energy consumption of up to 70-80%.

Three Ways to Drive Efficiency:

I. More efficient AI models and their use:

Optimise algorithms and deployment strategies by reducing computational resource requirements, which in turn would result in improved energy consumption. This can be achieved through techniques such as model pruning, quantization, and server capacity planning. Additionally, optimising deployment strategies ensures that AI models are implemented in ways that maximise their performance.

II. High performance chips and rack density

These innovations enable AI systems to handle larger datasets and more complex tasks while reducing latency and operational costs, making high-performance chips a critical component in driving efficiency across various AI applications.

III. Improving cooling efficiency

While some mitigation techniques can introduced downstream, the most effective approach is minimising data generation and storage at source. These strategies not only reduce operational costs but also contribute to sustainability by minimizing the environmental impact of AI infrastructure.

By having limited resources, technology firms have a high potential to innovate in this space. Speaking exclusively to Eco-business, Ingenie’s Chief Executive Tatiana Collins commented:

"Look at how Chinese firms have managed to dramatically reduce the cost of solar panels. It is similar with AI. Tech start-ups in China have had to make their technology cheaper to be competitive – and that's why I believe they will also win in making AI more efficient."

Take control of your investments

As investment intelligence experts, Ingenie helps investment managers navigate this complex landscape by providing detailed analysis of:

Market trends and growth projections

Double materiality impact assessment and considerations affecting asset viability

Technological innovations that may disrupt current business models

Identification of new investment opportunities from portfolio synergies

Risk management across the entire asset management lifecycle

With AI transforming the data center landscape, investment managers need expert guidance to identify opportunities while managing risks. Ingenie's comprehensive approach to identifying and managing risks in the investment portfolio ensures clients can make informed decisions throughout the asset management lifecycle, from initial capital allocation to ongoing portfolio management and eventual divestment strategies.